Leasing a Truck vs. Buying: What’s Best for Your Business?

When it comes to leasing a truck vs buying, deciding which option is right for your business is an important choice. However, it doesn’t have to be an all-or-nothing decision—many businesses successfully combine both approaches to suit their unique needs. Factors like how often you use your trucks, your budget, and your business’s operational goals all play a role in this decision. Each option has its advantages and trade-offs, and at HK Truck Center, we’re here to help you navigate the pros and cons to find the best solution for your fleet.

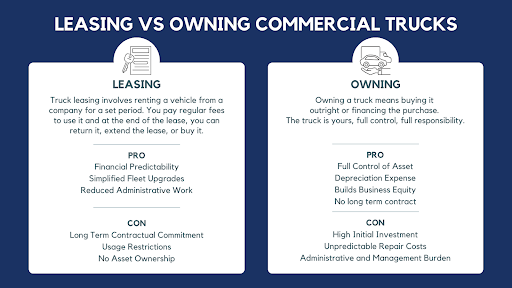

Leasing vs. Buying Commercial Truck

Managing a commercial truck fleet requires a strategic choice between two main paths: leasing or owning. Each has its perks and pitfalls, and understanding the basics can help you make the right call for your business.

Truck Leasing

Leasing a truck is like renting it for the long term. You enter into a contract with a leasing company to use the vehicle for a specified period. You pay a recurring fee, usually monthly, for the right to operate the truck. The truck remains the property of the leasing company, and at the end of the lease term, you can return the truck or replace it with a newer model.

Truck Ownership

Owning a truck means buying it outright or financing the purchase. The truck is yours—title and all—and that comes with total control.

Of course, ownership also means full responsibility. Maintenance, repairs, and compliance are all on you. And as the truck ages, repair costs tend to climb, while its resale value dips.

Pros and Cons of Leasing and Owning Commercial Trucks

Now that we’ve covered what leasing and owning a truck mean, let’s dig into the nitty-gritty. Beyond the basics, both options come with unique benefits and challenges that can tip the scales depending on your business goals. Let’s break it down further.

Pros of Leasing a Truck

Financial Predictability

Leasing gives you a clear view of your monthly expenses. With fixed payments that often include maintenance, you’re not caught off guard by surprise repair bills or big upfront costs. It’s all about keeping things steady and manageable.

Simplified Fleet Upgrades

When your lease ends, it’s easier to swap your truck for a newer model. This keeps your fleet modern without the hassle of selling old vehicles.

Reduced Administrative Work

Leasing companies often handle the nitty-gritty details, like permits, licensing, and compliance. They make the decisions on repairs and maintenance to keep the truck in good running shape and help avoid inspection tickets. That’s less paperwork, reviewing of estimates and fewer headaches for you.

The Cons of Leasing

Long-Term Commitment

Leasing a truck is a long term contractual commitment. These contracts are often 5-8 years depending on your usage, budget and specifications.

Usage Restrictions

Leases often come with rules—mileage caps, wear-and-tear limits, and usage terms.

No Asset Ownership

Since you’re not buying the truck, it won’t create more debt on your balance sheet. This means you will not get the depreciation benefits that come with ownership of the vehicle. However, this can ultimately be a ‘pro-in-disguise’ because without the loan impacting your finances, you are more open to exploring other financial opportunities.

Pros of Owning a Truck

Full Control of Asset Without A Contract

You’re in charge. Modify the truck, use it as needed, sell it, trade it in, and skip the worries about mileage limits or other restrictions. It’s your truck, your rules. This flexibility allows you to adapt to changing business needs more freely without any long term contracts.

Builds Business Equity and Depreciation Expenses

Ownership gives you a tangible asset that adds value to your balance sheet. You can sell it or trade it as it benefits your business. You now have a depreciable asset to offset profits and tax liability.

Cons of Owning

High Initial Investment

Buying a truck requires a significant upfront expense or financing, which can strain your budget or tie up capital you could use elsewhere.

Unpredictable Repair Costs

When something breaks, it’s all on you. As trucks age, repair costs tend to pile up, making ownership more expensive over time. Trucks are becoming more complicated and the cost of each repair becoming a larger out of pocket expense, often at the worst time.

Administrative and Management Burden

As trucks and regulations become more complicated, many fleet managers find more of their time is dedicated to reviewing estimates, making repair and maintenance decisions, as well as keeping up with regulations, taxes, and licensing paperwork. This requires an experienced fleet manager to keep up with this work and make decisions when to repair, purchase and sell trucks most efficiently. In addition to this administrative burden, the risk of used truck market values, marketability, and the time it takes to meet with buyers need to be considered as well.

How HK Truck Center Can Help You Decide

At HK Truck Center, we understand that every business has unique needs when it comes to fleet management. That’s why we’re here to guide you through the decision-making process of leasing versus owning. Whether you’re drawn to the flexibility of leasing or the long-term control of ownership, our team of experts will help you evaluate your operational requirements, financial goals, and fleet usage patterns to find the best fit for your business.

We offer flexible leasing plans that cover everything from maintenance and emergency road service to permits and compliance, ensuring a hassle-free experience. If ownership is the right path for you, we offer new and used Hino trucks, backed by knowledgeable sales staff ready to help you choose the right vehicle. With locations in South Plainfield and Parsippany, NJ, and a reputation as the tri-state area’s premier truck dealership, HK Truck Center is here to support your fleet decisions and drive your business forward.